#Household budget spreadsheet free free

8 Free Budget Spreadsheets to Make Life Easier 1. Many come with budget templates to use, where you can just plug-and-chug your own information easy-peasy. There are lots of different ways that you can set up a budget using a spreadsheet – it’s all about what works best for you. Many spreadsheets come with help options or you can check the manufacturers’ website for instructions- but my favorite is watching a YouTube video so I can get a play-by-play of the action and repeat it myself.

#Household budget spreadsheet free how to

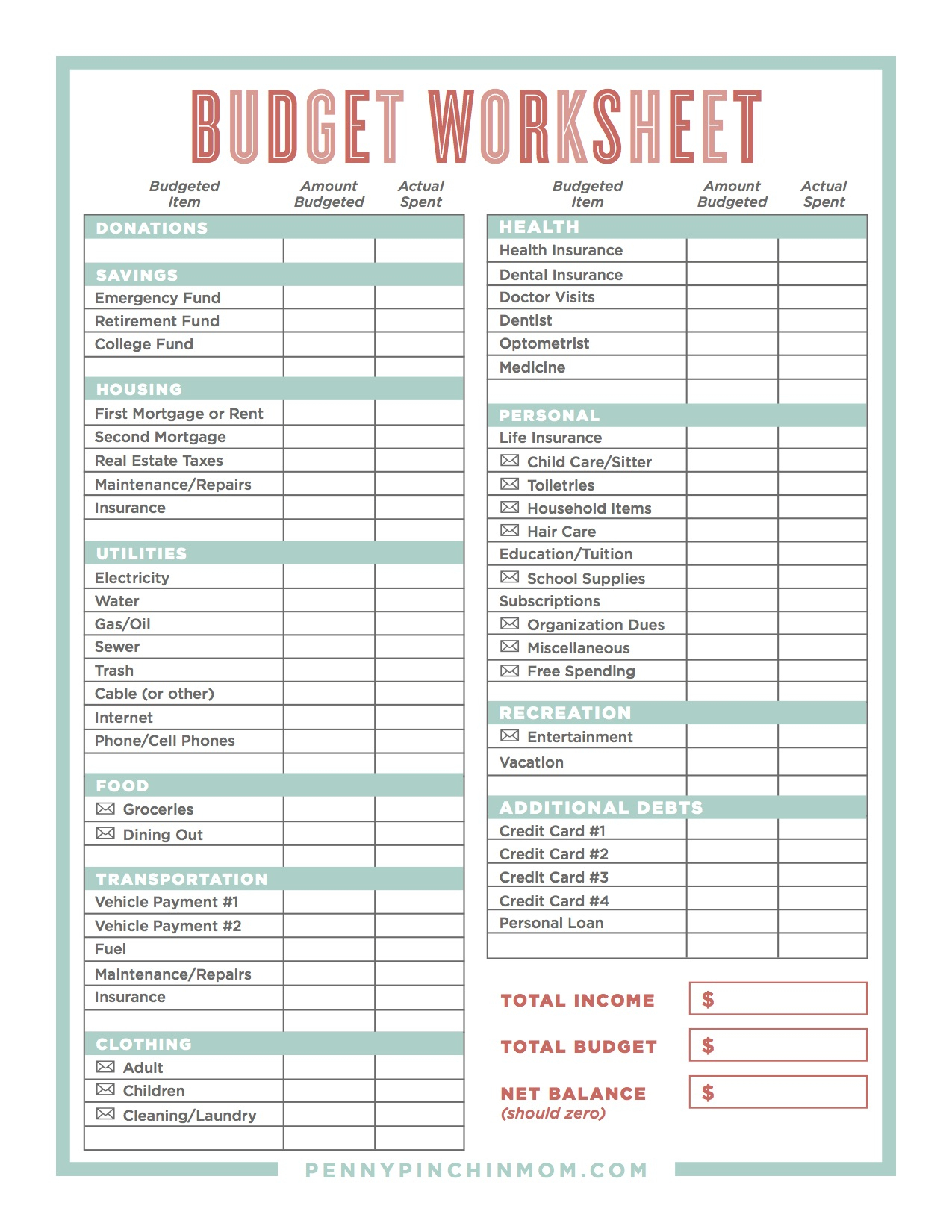

How to Budget with a SpreadsheetĪ budget spreadsheet is what you want if you’re looking for something quick and responsive and can do all of the math and number crunching for you. If your goal is to obtain a bright financial future, you need a budget to get started and keep you on track. We actually think that if you want to do fun things, you needto budget. However, here at The Savvy Couple, we think of things a bit differently. We tend to give it a bad rep generally because we hear people turn down things like fun nights out because they’re “on a budget” – which means that we equate budgets with not being able to do fun things. Printable Spreadsheetsīudgets get a bit of a bad rep for sometimes being time-intensive, but we think that it’s essential when it comes to building wealth. 8 Free Budget Spreadsheets to Make Life Easier.Learn how to make a household budget and use it to monitor expenses and save money. īy checking in regularly and monitoring progress, you’ll keep your budget effective and relevant to your savings goals, making it easy to see the positive difference it makes to your everyday finances.

Revisit your budget regularly - every six months, for example - and compare what you thought you’d spend to what you’re actually spending. Your expenses will likely vary from month to month, especially if you’re a homeowner or have children. By looking at where your money is going - and where you want it to go - you can use your budget to help control your finances. This is how your budget becomes not merely an exercise, but a powerful financial management tool. If the balance is negative, you need to rethink your spending or consider ways to increase your income. Be sure to put this money aside, to cover months when expenses are higher or income is lower. Your magic number comes from subtracting your estimated monthly expenses from your household income.Ī positive balance means you will have money left over to save for future needs. (Our Budget Template provides the totals automatically.)

List all your expenses for a typical month, dividing them into major categories. Interest from a savings account or investment earningsĪdd up the total (our Budget Template tallies it automatically).Employment insurance or other government benefits.List all of the money you and your spouse or partner have coming in. Making a budget is simpler than you might think - just follow these steps, and use our household Budget Template to make it even easier. A household budget can really help you manage your money and be a better saver.

0 kommentar(er)

0 kommentar(er)